Hello,

The 73rd International Softwood Conference brought 260 industry leaders to Oslo last week. The verdict: 2026 could bring recovery. But that's the good news.

The challenging news: European spruce supply is shrinking permanently. German stocks face substantial long-term decline. Sawmill capacity sits underutilized. And the gap between what mills need and what forests can sustainably provide keeps widening.

Meanwhile, Swedish forest group Holmen just secured €100 million from the European Investment Bank for wind energy. Lower Saxony's official forest health report shows record crown damage. And FSC launched a major standards revision that could reshape certification for millions of hectares.

Here's what's moving European forestry this week:

🔍 The Big Story

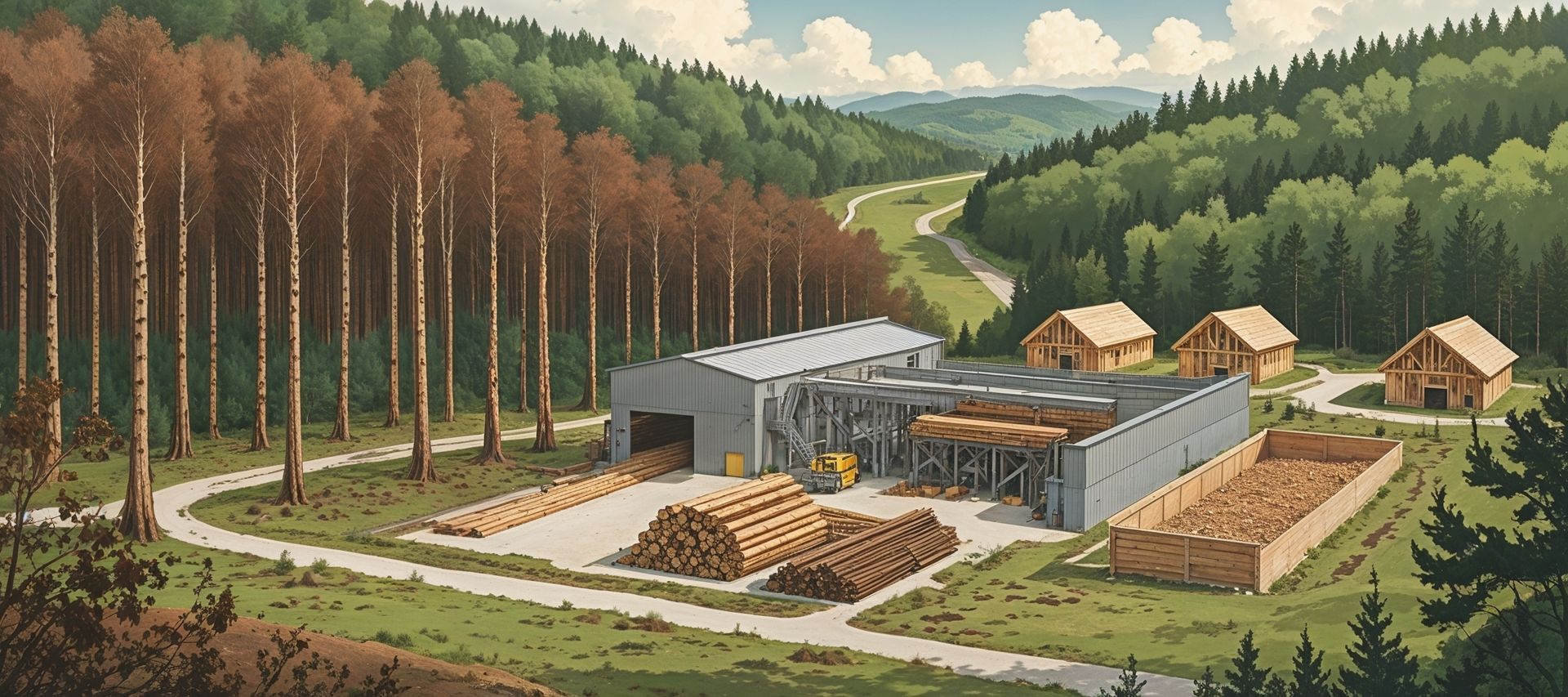

Oslo Conference Reveals European Softwood's Recovery Path – And Its Raw Material Crisis

The 73rd International Softwood Conference brought together over 260 industry participants in Oslo on October 22-23, 2025, to assess European softwood markets. The verdict: 2026 could bring construction market recovery. But a raw material crisis threatens long-term supply.

The production reality: EOS member countries cut softwood production about 10% since the 2021 peak. Mills adjusted to weaker demand. Production stabilized in 2024-2025. But capacity remains underutilized. Construction demand hasn't recovered to pre-crisis levels. The industry operates below its potential while facing permanent supply constraints.

The supply crisis: European spruce volumes are declining. Beetle damage reduced available timber. German spruce volumes have declined significantly in recent years with further substantial reductions expected through 2050. This isn't temporary market adjustment. It's structural change. The raw material base is shrinking while mills still have capacity to process more.

The price paradox: Sawlog prices hit records across Europe. €110-125/m³ in most markets. Sweden reached €150-160/m³. But lumber prices haven't kept pace. This gap crushes sawmill profitability. Forest owners benefit. Sawmillers struggle. The middle of the supply chain bears the pressure.

The 2026 outlook: European Timber Trade Federation forecasts stable EU production and consumption next year. German government stimulus could boost demand. Johan Freij, delivering the economic overview, noted "exceptional uncertainty" but stressed that "with inflation coming down, 2026 could be the year of recovery in construction markets."

What this means for you: Log price strength continues despite weak construction. Supply constraints support pricing. But sawmill margins remain compressed. If you're selling logs, market conditions favor sellers. If you're buying lumber, expect continued price pressure. The structural supply shortage means this dynamic persists beyond any cyclical recovery.

The longer view: German spruce decline signals broader shifts. Climate change accelerates tree mortality. Beetle damage becomes chronic rather than episodic. Forest owners face species diversification pressure. Markets must adapt to permanently reduced spruce availability. This reshapes European softwood markets for decades, not years. Sources: Timber Trade Journal | Wood Central | GlobalWood Markets Info

📊 Quick Hits

1. 💰 EIB Lends €100 Million to Holmen for Wind Energy Expansion

The European Investment Bank announced a loan of 1.1 billion Swedish kronor (approximately €100 million) to Stockholm-based forest group Holmen on November 2 to expand onshore wind installations in northern Sweden. The financing supports renewable energy generation in Sweden's northernmost electricity bidding zones where energy demand is expected to increase from electricity-intensive industries.

Holmen is one of Sweden's largest forest owners and operates in forestry, wood products, paper, paperboard, and energy. The investment demonstrates vertical integration strategy where forest industry companies invest in renewable energy generation while maintaining forest operations.

The takeaway: European support for forest-based companies diversifying into clean energy shows industry evolution beyond traditional timber and paper products. Sources: European Investment Bank | Market Screener

2. 🇩🇪 Lower Saxony Forest Condition Deteriorates - Official 2025 Report

The 2025 Forest Condition Report for Lower Saxony shows crown defoliation reached a new maximum of 23% across all tree species, approximately 6 percentage points above the long-term average. The vegetative year (October 2024-September 2025) saw drought from February to June despite good initial soil water storage.

Key findings: Spruce shows 32% crown defoliation in older trees (most affected species). Oak shows 34% crown defoliation overall, 39% in older oaks (new peak). Severely damaged trees represent 4.2% (up from 3.4% in 2024). Mortality rate is 0.23% (lowest since 2019, down from 0.4% in 2023). Bark beetle damage dropped to 11,649 cubic meters (down from 27,119 m³ in 2024).

The report notes that despite precipitation in 2024, the 2025 drought ended the recovery phase for Lower Saxony's forests.

The takeaway: Official government monitoring confirms ongoing forest health decline in major German forestry region, indicating continued challenges for forest management and timber quality. Sources: Lower Saxony Ministry of Agriculture | NW-FVA

3. 🌱 FSC Opens Public Consultation on Forest Management Standards Revision

The Forest Stewardship Council launched consultations on October 1, 2025 (through November 30) for revision of its Principles and Criteria (P&C) and development of country requirements. The consultation seeks input on making standards more user-oriented, outcome-oriented, and risk-based.

Key topics include streamlining P&C structure through a modular approach, revising scope to include urban forests, strengthening social requirements (gender equality, Indigenous Peoples' rights), and addressing climate change, biodiversity conservation, and forest resilience. Consultations available in English, Spanish, and French.

The takeaway: Major revision of world's leading forest certification system will affect certification requirements for forest owners globally. Risk-based approach could reduce burden on certificate holders while maintaining environmental and social standards. Sources: FSC International | FSC Canada

4. 🏭 Stora Enso Q3: Sales Up 1% But EBIT Down 28%

Stora Enso published Q3 2025 results on October 23 showing sales of €2,283 million (+1% year-over-year) and adjusted EBIT of €126 million (-28% YoY). The decline in EBIT was primarily due to a €45 million impact from ramping up the new production line in Oulu, Finland.

Net debt decreased by almost €800 million to €3.2 billion, reflecting positive impact from forest asset divestment of SEK 9.8 billion (~€900 million). Net debt to EBITDA improved to 2.7 (from 3.1). The company noted it is one of Europe's largest sawmillers but is strategically focusing on Renewable Packaging growth.

The takeaway: Major European forest industry player shows mixed results - revenue growth but profitability impacted by major capital investment. Significant debt reduction through forest asset sales indicates portfolio optimization strategy. Sources: Stora Enso | Stock Titan

📅 The Weeks Ahead

November 10-21, 2025: COP30 Climate Summit in Belém, Brazil – The "forest COP" with major forest carbon and REDD+ announcements expected (Conference Nov 10-21)

November 13, 2025: Forest Europe high-level dialogue on geopolitical emergency preparedness (online, 9:00-11:30 CET) – Focus on forests' role in energy, food, transport during crisis

November 19-22, 2025: Vietnam Wood Show in Ho Chi Minh City – Asia-Pacific export opportunities for European timber

November 24-December 5, 2025: CITES Conference in Samarkand, Uzbekistan – Timber trade regulations and species protection discussions

💡 One Thing to Try This Week

Calculate your breakeven sawlog price for 2026. With Oslo conference projecting recovery but raw material crisis deepening, run the numbers now.

Three steps, 30 minutes:

Take your current sawlog price (or average price last 6 months)

Add expected cost increases: transport (+5-8%), insurance (+10-15%), compliance (+€2-5/m³ EUDR)

Compare against forward lumber prices or contracts

If breakeven is above €130/m³, you're in the supply squeeze zone. If you're a forest owner, market conditions favor holding for higher prices. If you're a sawmill, consider forward contracts or species diversification.

The gap between log prices and lumber prices won't close quickly. Know your numbers before it gets worse.

Until Tuesday!

Wish you all the best: Peter

P.S. What’s the biggest challenge you’re facing in forestry right now?

Hit reply and let me know — I read every message personally.

P. P. S. Know a forest professional who’s drowning in EUDR complexity or missing out on timber market shifts? Forward this email to them!

📩 Got this email forwarded to you? Subscribe to ForestryBrief here.

📚 Missed an issue? Browse the ForestryBrief archive

If you like FB be sure to subscribe to Boreal Tech Brief, a newsletter of my friend Axel covering tech in forestry with a Nordic angle: