Hello,

Record log prices meet weak lumber demand. German spruce stocks projected to fall significantly by 2050. Sawmills struggle while forest owners see €150/m³ in Sweden. But industry leaders gathered in Oslo see hope for 2026 recovery.

Meanwhile, Ireland faces a €2 billion bark beetle threat just 30km away. Ponsse signals market weakness with layoff negotiations. And wood-based innovation wins top sustainability prize by replacing fossil materials in tyres.

Here's what's moving European forestry this week:

🔍 The Big Story

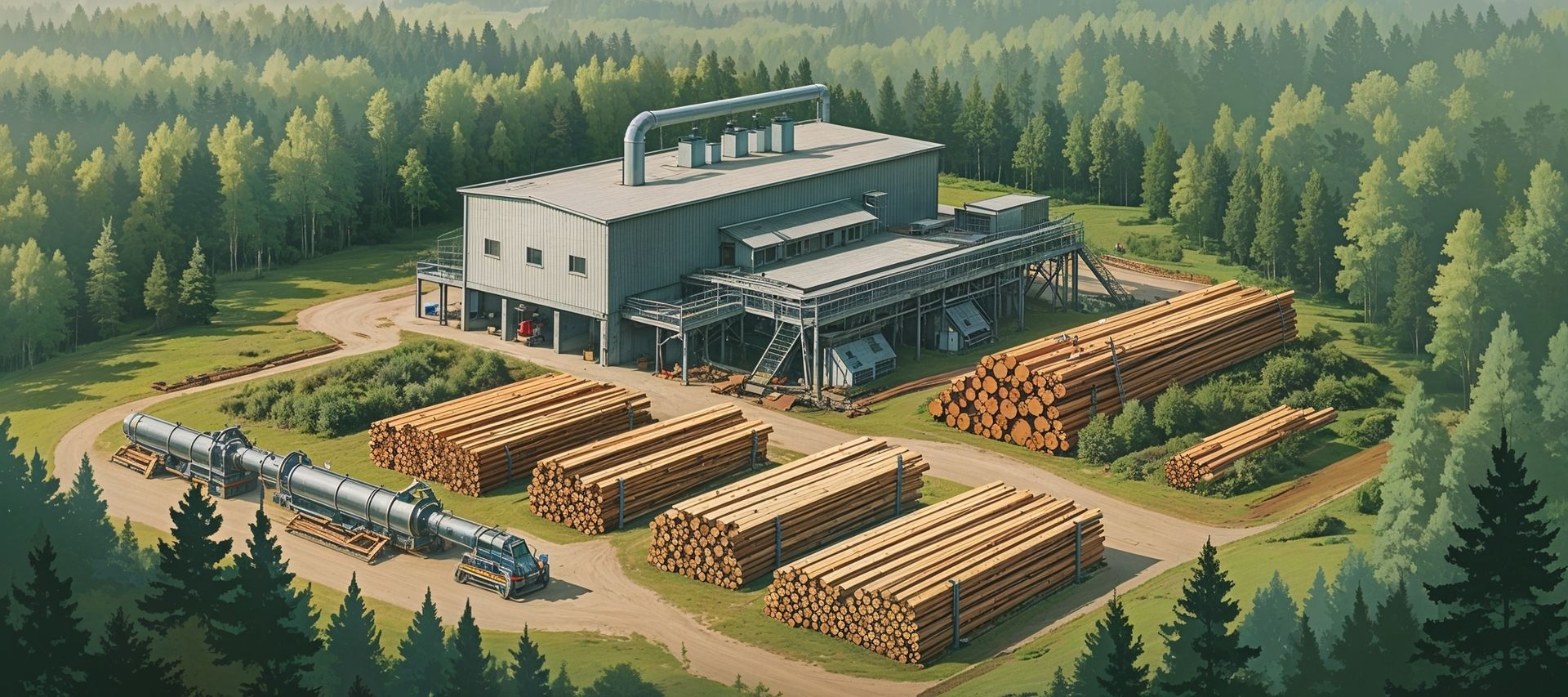

Oslo Conference Reveals European Softwood's Recovery Path – And Its Raw Material Crisis

The 73rd International Softwood Conference brought together over 260 industry participants in Oslo on October 22-23, 2025, to assess European softwood markets. The verdict: 2026 could bring construction market recovery. But a raw material crisis threatens long-term supply.

The price paradox: Sawlog prices hit records across Europe. €110-125/m³ in most markets. Sweden reached €150-160/m³. But lumber prices haven't kept pace. This gap crushes sawmill profitability. Forest owners benefit. Sawmillers struggle. The middle of the supply chain bears the pressure.

The supply crisis: European spruce volumes are declining. Beetle damage reduced total available timber. German spruce volumes have declined significantly in recent years with further substantial reductions expected through 2050. The raw material base is shrinking. This isn't temporary market adjustment. It's structural change.

The production response: EOS member countries cut softwood production about 10% since the 2021 peak. Mills adjusted to weaker demand. Production stabilized in 2024-2025. But capacity remains underutilized. Construction demand hasn't recovered to pre-crisis levels.

The 2026 outlook: European Timber Trade Federation forecasts stable EU production and consumption next year. German government stimulus could boost demand. Johan Freij, delivering the economic overview, noted "exceptional uncertainty" but stressed that "with inflation coming down, 2026 could be the year of recovery in construction markets."

What this means for you: Log price strength continues despite weak construction. Supply constraints support pricing. But sawmill margins remain compressed. If you're selling logs, market conditions favor sellers. If you're buying lumber, expect continued price pressure. The structural supply shortage means this dynamic persists beyond any cyclical recovery.

The longer view: German spruce decline signals broader shifts. Climate change accelerates tree mortality. Beetle damage becomes chronic rather than episodic. Forest owners face species diversification pressure. Markets must adapt to permanently reduced spruce availability. This reshapes European softwood markets for decades, not years. Source: Timber Trade Journal, Wood Central, GlobalWood Markets Info

📊 Quick Hits

1. 🇩🇪 German Sawmill Industry in Crisis Mode

The German sawmill industry is heading toward its lowest production year in recent history, with up to 95% of cutting capacity affected by production cuts as of October 2025. Contributing factors stack up: severe construction slump in residential building due to high interest rates, fresh log supply constrained after beetle-damaged wood supply ended, and small forest owners considering harvest suspension to avoid EUDR compliance burden. The crisis combines weak demand with supply constraints. Mills face high log prices but can't pass costs to customers in collapsed construction markets. The business model is broken.

The takeaway: Germany's sawmill sector faces perfect storm of weak demand, supply constraints, and compliance concerns. Source: Forest Machine Magazine

2. 🇫🇮 Ponsse Signals Market Weakness with Layoff Negotiations

Forest machinery manufacturer Ponsse Plc initiated cooperation negotiations on October 22 with its entire Finnish staff (1,086 employees) regarding potential temporary layoffs of up to 90 days during 2026. "The weakening demand in the forest industry and the decrease in timber harvesting volumes had a negative impact on the demand for forest machines, which was particularly evident in the Finnish market," said CEO Juho Nummela. The company's order backlog is declining. Production adjustments in Vieremä may be needed for 2026. Importantly, negotiations concern layoffs only, not terminations. Subsidiary Epec Oy is excluded.

The takeaway: Major machinery manufacturer's struggles reflect broader European forestry market challenges and reduced harvest volumes. Source: Ponsse Official Release, Forest Machine Magazine

3. 🇮🇪 Ireland Faces €2 Billion Bark Beetle Threat from Britain

The eight-toothed spruce bark beetle, which killed hundreds of millions of European spruce over the past decade, continues advancing through England and poses an imminent threat to Ireland's €2 billion timber industry, according to The Irish Times. The beetle now breeds in Sitka spruce in West Sussex. Sitka represents 50% of Irish forests. Beetles have traveled up to 400km by wind from Continental Europe. Ireland is less than 30km from Britain at the nearest point. "It can only be a matter of time before the beetle makes its way here," said Brian Tobin, assistant professor of forestry at University College Dublin. Industry warns an outbreak would "make ash dieback emergency look simple." Sitka and Norway spruce combined represent 48% of Irish forests versus only 3% for ash. Ireland's Department of Agriculture is developing a response plan at "advanced stage." But Met Éireann is not yet modeling wind dispersal patterns, unlike UK Met Office.

The takeaway: Imminent threat to Ireland's timber industry requires urgent preparedness action before windborne arrival. Source: The Irish Times

4. 🏆 Lignin-Based Tyre Wins New Wood Competition 2025

The Nokian Tyres Green Step Ligna concept tyre, developed with UPM, was named winner of the 2025 New Wood competition announced October 22 at Finlandia Hall, Helsinki. The innovation replaces fossil-based carbon black in tyre sidewalls with lignin-based UPM BioMotion™ Renewable Functional Fillers. These come from UPM's €1.3 billion biorefinery in Leuna, Germany—the world's first industrial-scale hardwood-to-biochemicals facility. Fillers constitute approximately 30% of tyre mass and critically affect durability and performance. Tyre wear accounts for up to 28% of ocean microplastic pollution according to UNEP data. The wood-based replacement could transform the automotive industry while reducing both fossil dependence and microplastic emissions. "Sometimes the most powerful innovations don't alter the product itself, but the materials behind it—transforming it into something truly sustainable," said Pauli Aalto-Setälä, jury member.

The takeaway: Wood-based material innovation proves viable for large-scale industrial applications beyond traditional forest products. Source: Finnish Forest Foundation, Nokian Tyres

5. 🇮🇹 Italian Glulam Imports Hit Record High

Italy imported 422,000 m³ of laminated timber (glulam) in January-July 2025, exceeding any comparable period on record. This represents a 12% increase versus 2024. Softwood lumber imports also rose substantially, up 11% year-over-year. July showed particularly strong performance: 410,000 m³ versus 271,000 m³ in July 2024.

The takeaway: Italian construction sector shows relative strength compared to northern European markets, creating opportunities for glulam exporters. Source: Timber-Online, Timber-Online

📅 The Weeks Ahead

October 26-31, 2025: FSC General Assembly in Panama City. Traceability debates and Intact Forest Landscapes policy decisions expected.

November 2, 2025: Luxembourg PEFC consultation closes. Cross-border certification harmonization outcomes.

November 10-21, 2025: COP30 Climate Summit in Belém, Brazil. The "forest COP" with major forest carbon and REDD+ announcements expected.

November 19-22, 2025: Vietnam Wood Show in Ho Chi Minh City. Asia-Pacific market opportunities for European timber exporters.

💡 One Thing to Try This Week

Calculate your breakeven sawlog price for 2026. With Oslo conference projecting recovery but raw material crisis deepening, run the numbers now.

Three steps, 30 minutes:

Take your current sawlog price (or average price last 6 months)

Add expected cost increases: transport (+5-8%), insurance (+10-15%), compliance (+€2-5/m³ EUDR)

Compare against forward lumber prices or contracts

If breakeven is above €130/m³, you're in the supply squeeze zone. If you're a forest owner, market conditions favor holding for higher prices. If you're a sawmill, consider forward contracts or species diversification. The gap between log prices and lumber prices won't close quickly. Know your numbers before it gets worse.

Until Thursday!

Wish you all the best: Peter

P.S. What’s the biggest challenge you’re facing in forestry right now?

Hit reply and let me know — I read every message personally.

P. P. S. Know a forest professional who’s drowning in EUDR complexity or missing out on timber market shifts? Forward this email to them!

📩 Got this email forwarded to you? Subscribe to ForestryBrief here.

📚 Missed an issue? Browse the ForestryBrief archive

If you like FB be sure to subscribe to Boreal Tech Brief, a newsletter of my friend Axel covering tech in forestry with a Nordic angle: